A report from Farm Credit Canada (FCC) says the food manufacturing sector in Canada has an opportunity to meet the growing demand for food globally.

FCC says the need to grow more food with the same or less inputs will increase as the global population expects to reach nearly ten billion people by the year 2050. They quote the Food and Agriculture Organization (FAO) saying “agricultural production needs to increase by 60% over 2005 levels to feed the world’s growing population.”

“When we look at food manufacturing in Canada, we see that they are already in a good position with abundant land and water resources, strong global reputation of safe and high quality food located in a food export-oriented country that holds many free trade agreements, and the ability to produce a really wide range of food products,” said Amanda Norris, a Senior Economist with FCC and author of the report.

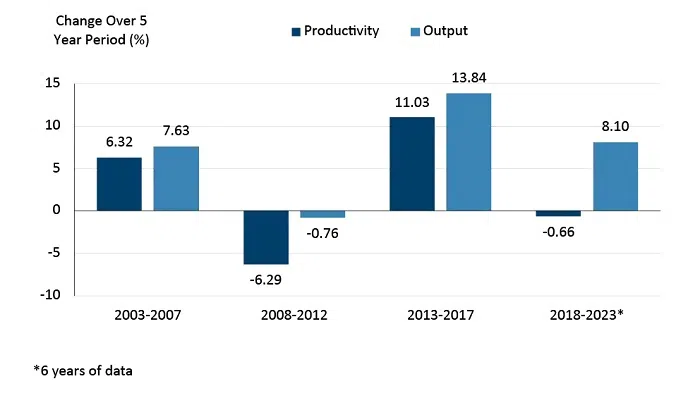

Productivity – measured by how well inputs are converted into outputs – has mostly increased over the past 20 years. A bar graph using numbers from Statistics Canada show productivity grew from 2003-2007, declined from 2008-2012, rose again from 2013-2017, then hitting a plateau from 2018 to 2023. The dip from the ’08-’12 period was mainly driven by a stronger Canadian Dollar that was on par with the U.S. Dollar, “which was good news for some, but not the export-oriented food manufacturing sector” says the report “the U.S., Canada’s largest market for exported food, now had to pay more for Canadian goods, reducing Canada’s price advantage. Jobs were cut, businesses were shutting their doors and output declined by 0.76% after years of strong growth.” In subsequent years, companies invested in new technologies and adjusted operations while the Canadian Dollar was strong. Productivity then increased by 11 per cent, according to FCC, “due somewhat to a weakening Canadian dollar but also the changes made through the hard years. Since then, productivity growth has remained relatively flat.”

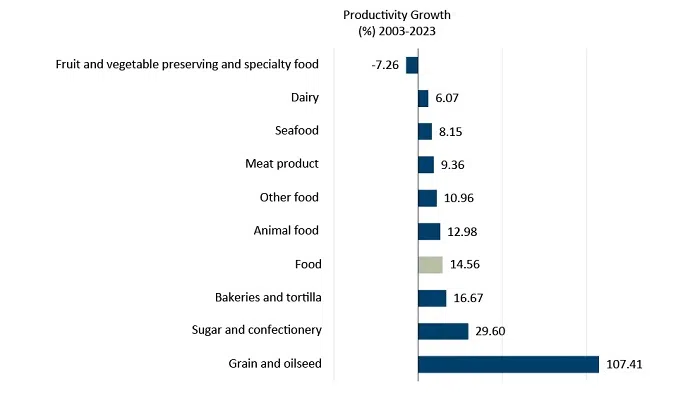

FCC then looked at productivity by sub-sector during the same timeframe, with the grain and oilseed sub-sector being the most productive by 107 per cent. Norris said the growth in grain and oilseed sub-sector is “led primarily by canola. There’s a strong global demand which has spurred strong investment and innovation into oilseed crushing capacity and this investment has really helped the sector in recent years (to) rapidly increase output.”

“When we look at other sub-sectors, all of the processing sectors do play an important role as consumers diets are diverse (and) are changing. The dairy, the grain and oilseed, fruit and vegetable, it’s all important to consumers diets.” she added.

She says one way to increase productivity in the sector is investing in new technology to scale-up production and increase efficiency. One example is artificial intelligence. She says A.I. can automate routine tasks such as maintenance schedules and quality control, and enhance decision making. “Also, something that maybe is more evolving and maybe more of an opportunity is to develop new product formulation that focus on minimizing costs, using certain ingredients while meeting different quality requirements, and so those are a few ways that A.I. can play a role in food manufacturing.” Norris said.

She acknowledged that each business and sub-sector is different – what may work in one may not necessarily work in another, so it’s important to utilize professional services, such as accountants and engineers, to explore whether A.I. and other technology is suitable for the operation.

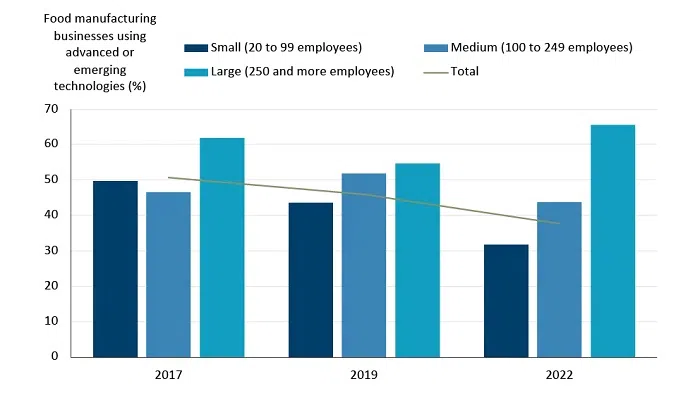

Large food manufacturing businesses – defined in the report as having 250 or more employees – have embraced the use of advanced and emerging technology compared medium and small sized businesses in the sector since 2017. About half of small businesses -having 20 to 99 employees – used new tech before the percentage steadily decreased over the next five years. The percentage for medium size businesses – having 100 to 249 employees – fluctuates between 40 and 50 per cent in the same time period.

Norris says one of the reasons why small and medium sized businesses may not be embracing new technology as much, is either seeing things like A.I. as not relevant or necessary at the moment, or the return on investment is not high enough to justify adoption.

For small businesses, she recommends “technology products that offer pricing structures that are scalable…to more easily customize to the business size.”

“Sometimes technology is made for maybe a large business and it’s not (to scale) if you’re a small or medium (size business),” she noted. She also said the technology must be integrated for long-term benefit and sustainability.